📌TL;DR:

AllTick’s HK Stock Real-Time Quote API provides ultra-low latency, real-time market data for over 3,000 Hong Kong stocks with an average delay of just 170 ms. It’s perfect for traders who need accurate, up-to-the-second insights for high-frequency trading or algorithmic strategies. Our API is easy to integrate, with free and paid plans available to suit different needs. Start accessing live data with no credit card required, and take your trading to the next level with AllTick’s fast and reliable data service.

Create Your AllTick Free Account

API Docs

Github

This article will introduce you to AllTick’s HK Stock Real-Time Quote API—your gateway to accessing precise, up-to-the-moment market data for the Hong Kong stock market. Whether you’re a seasoned trader or just starting out, understanding how to leverage real-time data is essential to staying ahead in the fast-paced world of stock trading.

As a team of industry experts with years of experience in financial data services, AllTick has become a trusted name for traders across Asia and beyond. With our knowledge and technical expertise, we’ll guide you through everything you need to know about integrating and using our HK Stock Real-Time Quote API.

Why Real-Time Data API?

In the world of high-frequency trading (HFT) and algorithmic trading, every millisecond can make or break a trade. For firms playing at this level in the Hong Kong stock market, real-time market data is like gold. It’s the competitive advantage that separates those who merely watch the action from those who shape it. The faster a firm’s systems can react to market shifts, the better the chance to capture profit opportunities before anyone else. Real-time data feeds give these firms the lightning-speed updates they need to execute trades at the perfect moment. For algorithms designed to operate in split seconds, any delay—however tiny—could mean missing out on crucial trades or even losing money in fast-moving markets.

The Hong Kong market, in particular, is a complex and sensitive beast, responding to an ever-shifting tapestry of regional and global forces. With its role as a bridge between East and West, the market doesn’t just hum to the beat of local economic indicators; it pulses with the rhythms of global news and economic shifts. A policy announcement from Beijing? That could spark immediate price swings. A key economic report out of the U.S. or a fluctuation in European markets? The Hong Kong exchange often feels the impact, sometimes within seconds.

And this sensitivity means one thing for traders relying on HFT and algorithms: they can’t afford to be behind the curve. Without real-time data, they’re left in the dust, outpaced by competitors who have that critical up-to-the-second view of what’s happening across the globe. Real-time data isn’t just a tool in Hong Kong; it’s the heartbeat of the market’s most competitive strategies, essential for those aiming to make sharp, calculated moves in an environment that thrives on speed and precision. For traders and platforms alike, it’s the defining edge in a landscape where the stakes are sky-high and the pace is relentless.

What is AllTick’s HK Stock Real-Time Quote API?

Since we launched in 2017, AllTick has been on a mission to set a new standard in real-time data, delivering precise, ultra-fast market information to our clients. From our base in Singapore, we’re expanding steadily across Asia—in Mainland China, Hong Kong, and even the U.S.—with a commitment to bring unparalleled speed and accuracy to the world’s most dynamic markets.

Our HK Stock Real-Time Quote API is built to deliver just that: immediacy. Designed for ultra-low latency, our API feeds real-time data directly to trading platforms, equipping clients with the most current and accurate market insights possible. Whether you’re an individual trader, a quantitative fund, or a full-scale brokerage, our data keeps you ahead of the curve, enabling you to act on market changes the very moment they happen. We’ve become the go-to choice for hundreds of trading platforms across Asia because our clients trust us to provide the speed and accuracy they need to stay competitive in real time.

We know that trading environments can be unpredictable and fast-paced, which is why we’ve engineered our API to handle even the heaviest trading demands without missing a beat. With a robust infrastructure built for high-frequency trading, our HK Stock Real-Time Quote API isn’t just fast—it’s designed to stay fast, no matter the trading conditions. From simple monitoring to complex algorithmic strategies, our API is a powerful tool for trading professionals who want to excel in the Hong Kong stock market.

How to Get Started with Our HK Stock Data API

Getting started with AllTick’s HK Stock Data API is quick and easy. Here’s how:

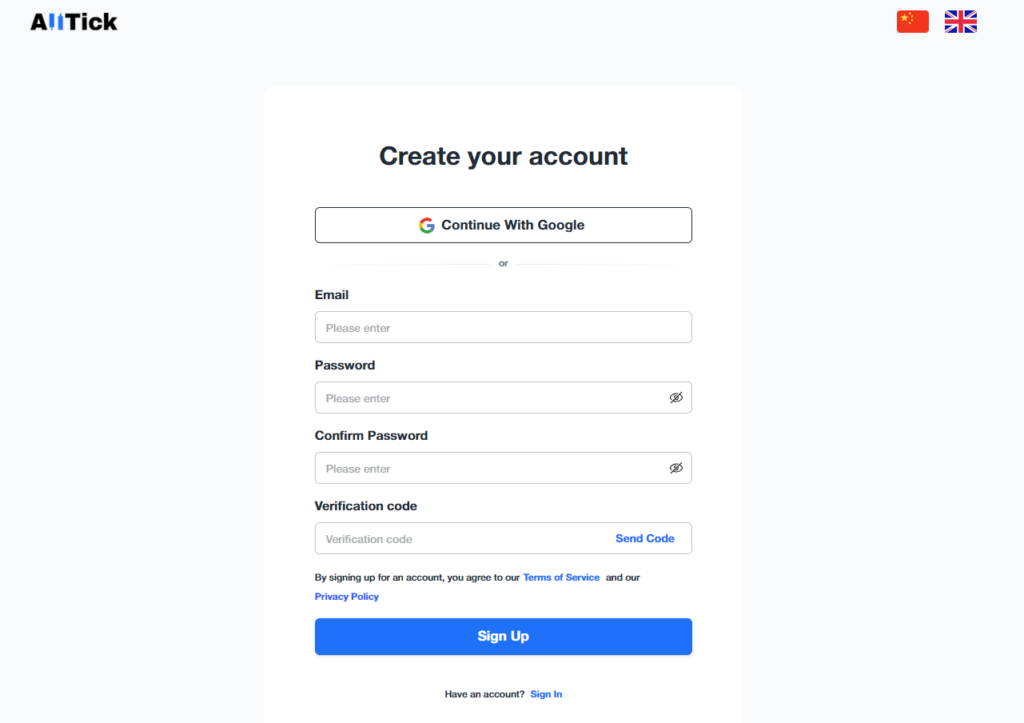

Create an Account

First, head over to our registration page and create your account at https://alltick.co/en-US/register. Registration is completely free, and no credit card is required. You can even simplify the process by signing up with your Google account.

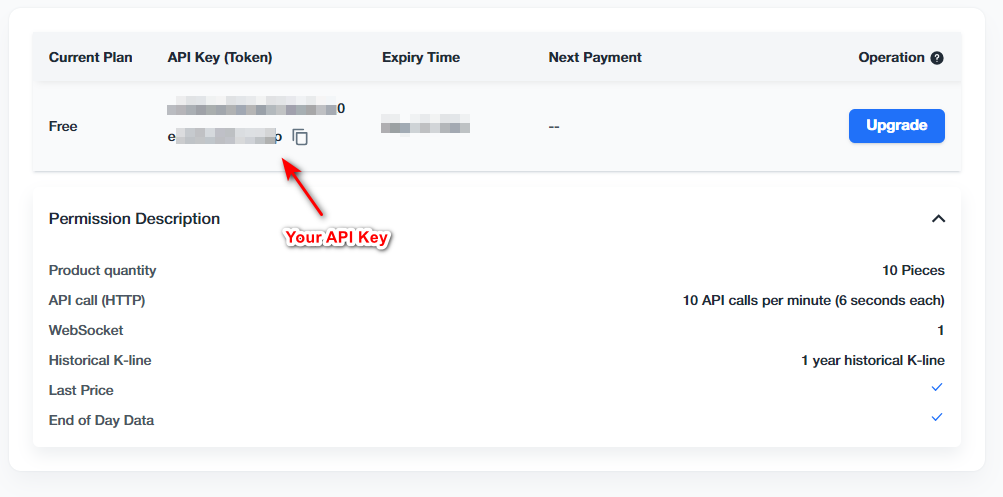

Access Your Dashboard and API Key

After you complete registration, you’ll be automatically redirected to your account dashboard. Here, you’ll see your very own unique API key. This key is essential for accessing our data and should accompany every data request you make.

With just a few steps, you’ll have everything you need to start leveraging AllTick’s real-time HK stock data. To help you make the most of our API, we recommend checking out our API documentation and exploring our GitHub repository for additional resources and examples.

And remember, if you need help or have questions, our support team is ready to assist. Let’s get you connected and trading with real-time insights!

FAQ

How many HK stocks can I access?

With AllTick’s API, you can access real-time market data for the entire Hong Kong stock market—about 3,000 stocks! For a full list of available stocks, check out this Google Sheet.

Do you offer a free plan?

Yes, we do! Our free plan comes with some limitations—you can access data for up to 100 stocks and send up to 10 API calls per minute. For more details on the free plan and our other options, please take a look at our pricing page.

How can I contact support?

We’re here to help! Reach out to us via any of the following channels:

What does “real-time” mean?

Real-time data from AllTick means there’s no 15-minute delays like you’d find with typical market feeds. Our data is live with an average delay of just 170 ms, keeping you up-to-the-moment in this fast-moving market.

Is historical data available?

Absolutely. Free plan users have access to 1 year of historical market data, while paid plans come with up to 5 years of data history. Perfect for backtesting and in-depth market analysis!

Code Example

In this example, we demonstrate how to access real-time market data for Hong Kong stocks using AllTick’s API. Specifically, we focus on retrieving data for HSBC (5.HK), one of the most prominent stocks in the Hong Kong market. This code example showcases how to fetch three types of data: Kline data (price trends), depth tick data (order book details), and trade tick data (individual trade transactions). By making simple API requests and parsing the results, you can integrate live stock data into your trading strategies. This is a great starting point for developers looking to leverage AllTick’s real-time stock data to stay ahead of market movements.

import time

import requests

import json

# Extra headers for the API request

test_headers = {

'Content-Type': 'application/json'

}

# Note: Replace "testtoken" in the URLs below with your actual API token.

# Define the API endpoints for different types of data, updating the stock code to "5.HK" for HSBC

test_url1 = 'https://quote.tradeswitcher.com/quote-stock-b-api/kline?token=testtoken&query=%7B%22trace%22%20%3A%20%22python_http_test1%22%2C%22data%22%20%3A%20%7B%22code%22%20%3A%20%225.HK%22%2C%22kline_type%22%20%3A%201%2C%22kline_timestamp_end%22%20%3A%200%2C%22query_kline_num%22%20%3A%202%2C%22adjust_type%3A%200%7D%7D'

test_url2 = 'https://quote.tradeswitcher.com/quote-stock-b-api/depth-tick?token=testtoken&query=%7B%22trace%22%20%3A%20%22python_http_test2%22%2C%22data%22%20%3A%20%7B%22symbol_list%22%3A%20%5B%7B%22code%22%3A%20%225.HK%22%7D%2C%7B%22code%22%3A%20%22UNH.US%22%7D%5D%7D%7D'

test_url3 = 'https://quote.tradeswitcher.com/quote-stock-b-api/trade-tick?token=testtoken&query=%7B%22trace%22%20%3A%20%22python_http_test3%22%2C%22data%22%20%3A%20%7B%22symbol_list%22%3A%20%5B%7B%22code%22%3A%20%225.HK%22%7D%2C%7B%22code%22%3A%20%22UNH.US%22%7D%5D%7D%7D'

# Send the first API request to retrieve kline data

resp1 = requests.get(url=test_url1, headers=test_headers)

time.sleep(1) # Pause for a moment to avoid hitting the rate limit

# Send the second API request to get depth tick data

resp2 = requests.get(url=test_url2, headers=test_headers)

time.sleep(1)

# Send the third API request for trade tick data

resp3 = requests.get(url=test_url3, headers=test_headers)

# Print the decoded text returned by each request

text1 = resp1.text

print("Kline Data:", text1)

text2 = resp2.text

print("Depth Tick Data:", text2)

text3 = resp3.text

print("Trade Tick Data:", text3)

WebSockets

You can also get live market data using WebSockets. The code example below shows you how to pull live data for Chow Tai Fook (1929.HK), one of the leading jewelry and retail brands in Hong Kong. This Python code leverages WebSocket technology to connect to our real-time market data feed, ensuring you receive instant updates for 1929.HK stock movements.

import json

import websocket # Ensure you have the websocket-client library installed: pip install websocket-client

'''

# Special Note:

# GitHub: https://github.com/alltick/realtime-forex-crypto-stock-tick-finance-websocket-api

# Token Application: https://alltick.co

# Replace "testtoken" in the URL below with your actual token.

# Stock API address:

# wss://quote.tradeswitcher.com/quote-stock-b-ws-api

'''

class Feed(object):

def __init__(self):

self.url = 'wss://quote.tradeswitcher.com/quote-stock-b-ws-api?token=testtoken' # Replace with your actual WebSocket URL and token

self.ws = None

def on_open(self, ws):

"""

Callback executed when the WebSocket connection is opened.

"""

print('A new WebSocketApp is opened!')

# Example subscription parameters

sub_param = {

"cmd_id": 22002,

"seq_id": 123,

"trace": "3baaa938-f92c-4a74-a228-fd49d5e2f8bc-1678419657806", # Unique trace identifier

"data": {

"symbol_list": [

{

"code": "1929.HK", # Chow Tai Fook stock code

"depth_level": 5, # Market depth level

}

]

}

}

# Send the subscription request to WebSocket

sub_str = json.dumps(sub_param)

ws.send(sub_str)

print("Depth quotes subscribed for 1929.HK!")

def on_message(self, ws, message):

"""

Callback executed when a message is received.

"""

# Parse the received message and print it

result = json.loads(message) # Safely parse the JSON message

print(result)

def on_error(self, ws, error):

"""

Callback executed when an error occurs.

"""

print(error)

def on_close(self, ws, close_status_code, close_msg):

"""

Callback executed when the WebSocket connection is closed.

"""

print('The connection is closed!')

def start(self):

"""

Initiates the WebSocket connection and starts the listener.

"""

self.ws = websocket.WebSocketApp(

self.url,

on_open=self.on_open,

on_message=self.on_message,

on_error=self.on_error,

on_close=self.on_close,

)

self.ws.run_forever() # Keeps the connection open and continuously listens for messages

if __name__ == "__main__":

feed = Feed()

feed.start() # Start the WebSocket feed

The script connects to the WebSocket API provided by AllTick, sending a subscription request that specifically targets Chow Tai Fook. Once connected, it listens for depth-level market data in real-time, which gives you a direct feed of trading activity, including order book updates.

This setup is ideal for developers and traders looking to integrate live stock data into their trading strategies or analytics platforms. The example is flexible and can be adapted to track other stocks listed on the Hong Kong Stock Exchange with just a few adjustments.

What to Consider When Choosing a HK Stock Market Data API

Selecting the right Hong Kong stock market data API can greatly impact trading success, data reliability, and overall user experience. Here are some crucial factors to keep in mind when evaluating API providers:

Data Accuracy

Real-time accuracy is paramount, but it’s important to note that higher-priced APIs don’t always deliver more accurate data. Some high-end providers promote their use of NBBO-backed (National Best Bid and Offer) data, which aggregates the best available bid and ask prices across multiple exchanges. However, some experts argue that even NBBO-backed data might not be the most precise in the market, as it can sometimes omit data from smaller exchanges or alternative trading venues. Therefore, it’s essential to evaluate both cost and accuracy to ensure you’re getting data suited to your trading needs.

Latency and Speed

Low latency is critical for active traders, as even a slight delay can impact trade timing and profitability. However, the cost-to-latency ratio is an important factor to weigh. For example, reducing latency from 170 milliseconds to 120 milliseconds can cost up to 10 times more, making it essential to balance the cost of low latency with your trading strategy requirements. Some traders may find that a moderate latency level is sufficient if their strategy doesn’t require ultra-high-frequency execution.

API Stability and Uptime

Consistent uptime and reliable performance are essential, particularly for 24/7 trading operations. A high-quality provider should offer guaranteed uptime, minimal downtime, and robust systems to handle high traffic volumes. Frequent interruptions can disrupt trading and lead to missed opportunities, so ensure the provider has a strong reputation for stability.

Alternative Options

If you’re exploring other options for accessing stock market data, there are some well-known alternatives to consider beyond specialized APIs like AllTick. Here’s an overview of two prominent choices that may suit various data needs and budget considerations.

Google Finance API

The Google Finance API was once a popular source for stock data, offering easy access to basic financial metrics, historical prices, and real-time quotes for a range of markets, including the Hong Kong stock exchange. However, it has largely been phased out in recent years, and Google now provides financial data only through its Google Sheets integration. Using Google Sheets, you can leverage the GOOGLEFINANCE function to pull basic stock data directly into a spreadsheet.

Pros: Google Sheets integration is a quick, easy, and free way to access basic stock data, which can be beneficial for individual investors or those with simpler data needs.

Cons: Google’s limited functionality and lack of a dedicated API restrict it from being a robust solution for high-frequency trading or professional use. The data refresh rate is also not suited for real-time or ultra-low-latency applications, and customization is minimal.

Best For: Beginners, individuals analyzing smaller datasets, or anyone needing quick access to basic stock prices and historical data for personal projects.

Bloomberg

Bloomberg is a major name in financial data, renowned for its comprehensive data coverage and sophisticated analytics capabilities. Through its Bloomberg Terminal or Bloomberg Data License, Bloomberg offers extensive real-time and historical data for the Hong Kong stock market, as well as global equities, commodities, forex, and other asset classes. The Bloomberg API provides robust access to financial data and advanced analytical tools, making it a powerful choice for institutions and professional traders.

Pros: Bloomberg’s data accuracy, depth, and range are unparalleled, covering everything from real-time price movements and historical data to in-depth analytics, news, and research. The API supports real-time data streaming and offers low-latency solutions for active traders and institutions.

Cons: Access to Bloomberg’s data services, particularly the API, is among the most expensive on the market. The setup and subscription fees are generally prohibitive for individual investors or smaller operations, and the platform’s complexity may be excessive for users with basic data needs.

Best For: Institutional investors, professional traders, or large financial organizations that need comprehensive market data, research, and analysis tools and have the budget to support a premium service.

Get Your Real-time Market Data Today!

Ready to take your trading strategy to the next level with real-time market data? AllTick’s API gives you the speed and accuracy you need to stay ahead of the curve.

Sign up today and start leveraging our powerful real-time data feeds to enhance your market insights. Don’t let delays cost you—experience the difference with AllTick!

Need help or have questions? Our support team is just a message away. Let’s get you connected and trading smarter!